1. Overall Inflation

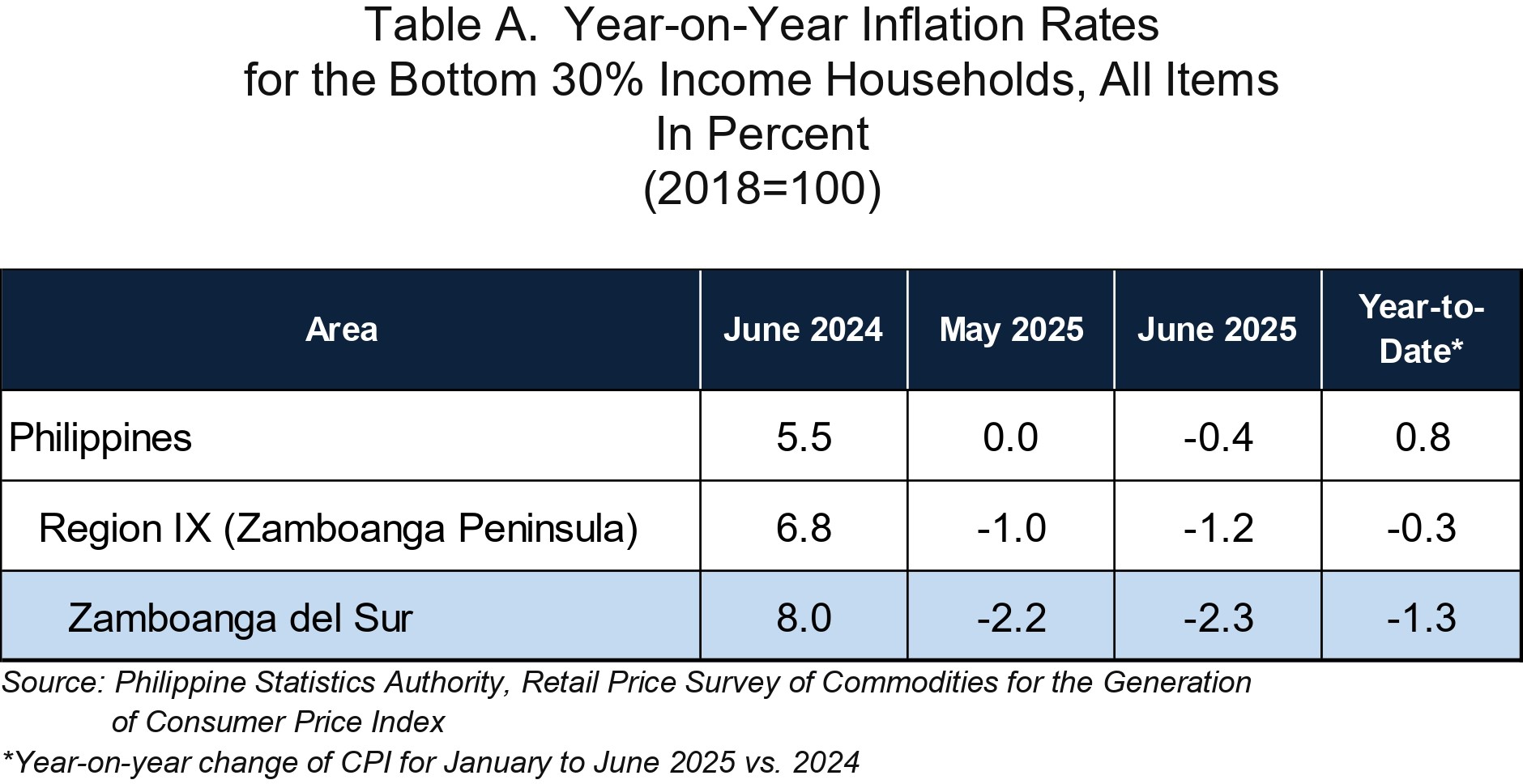

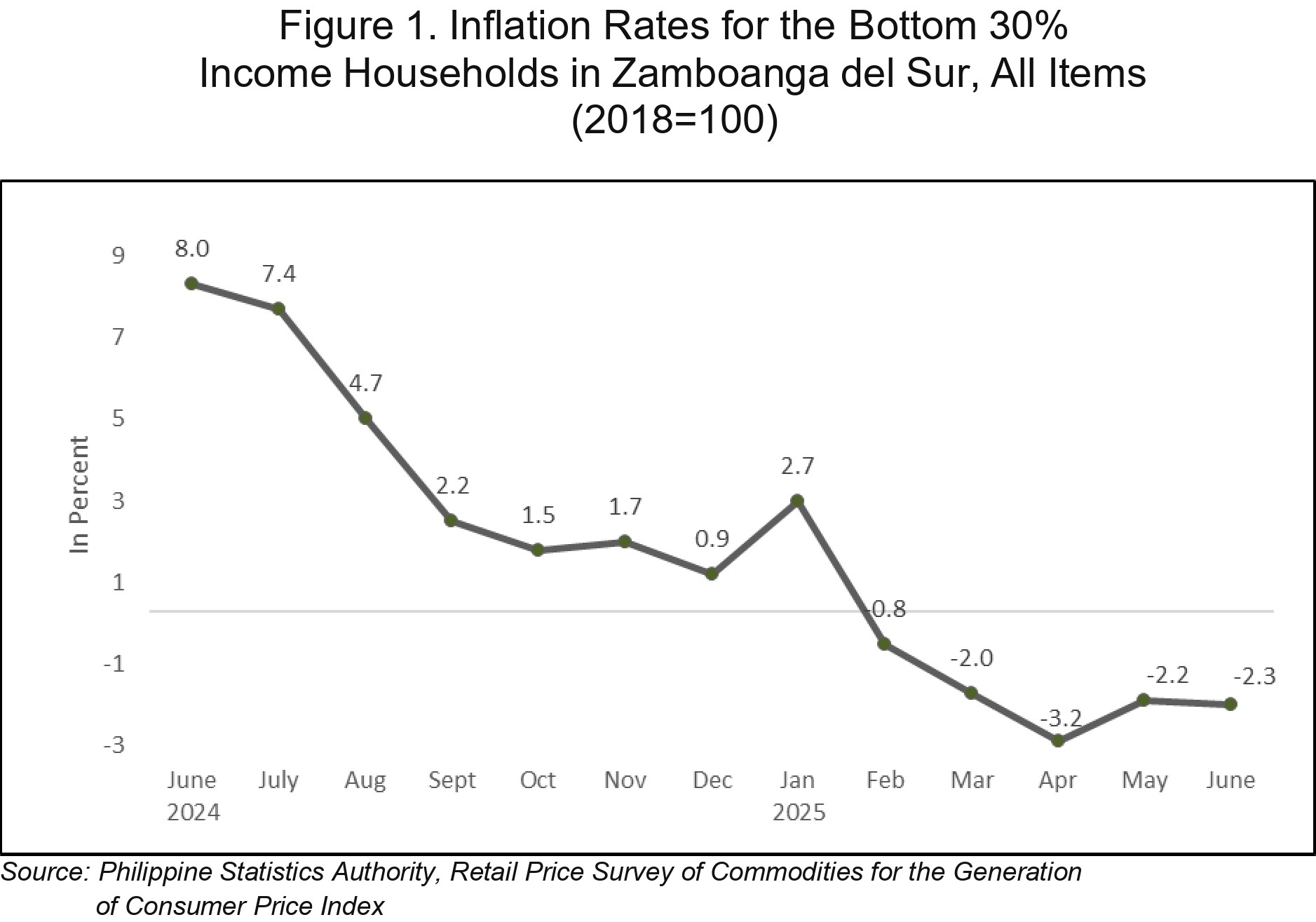

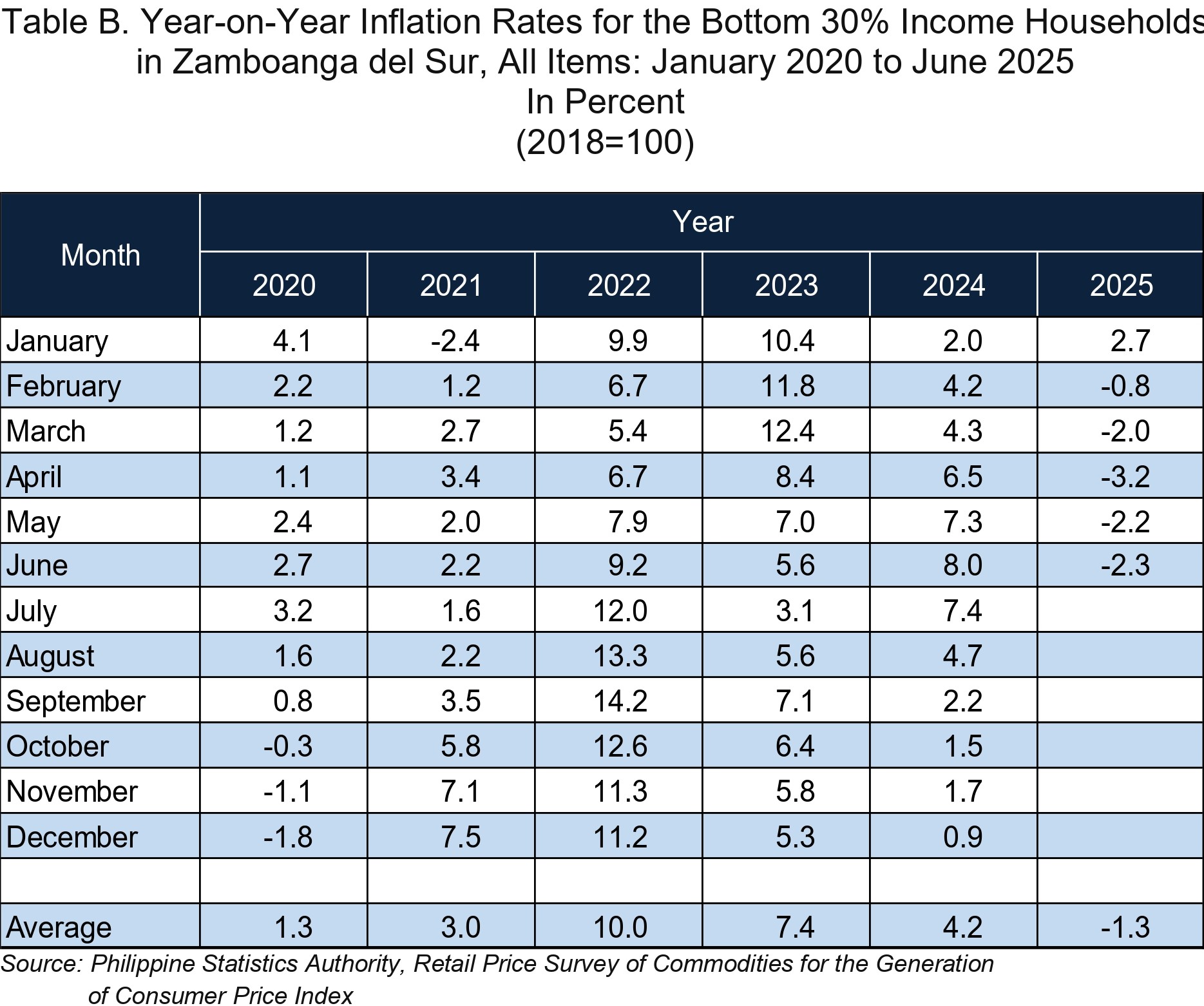

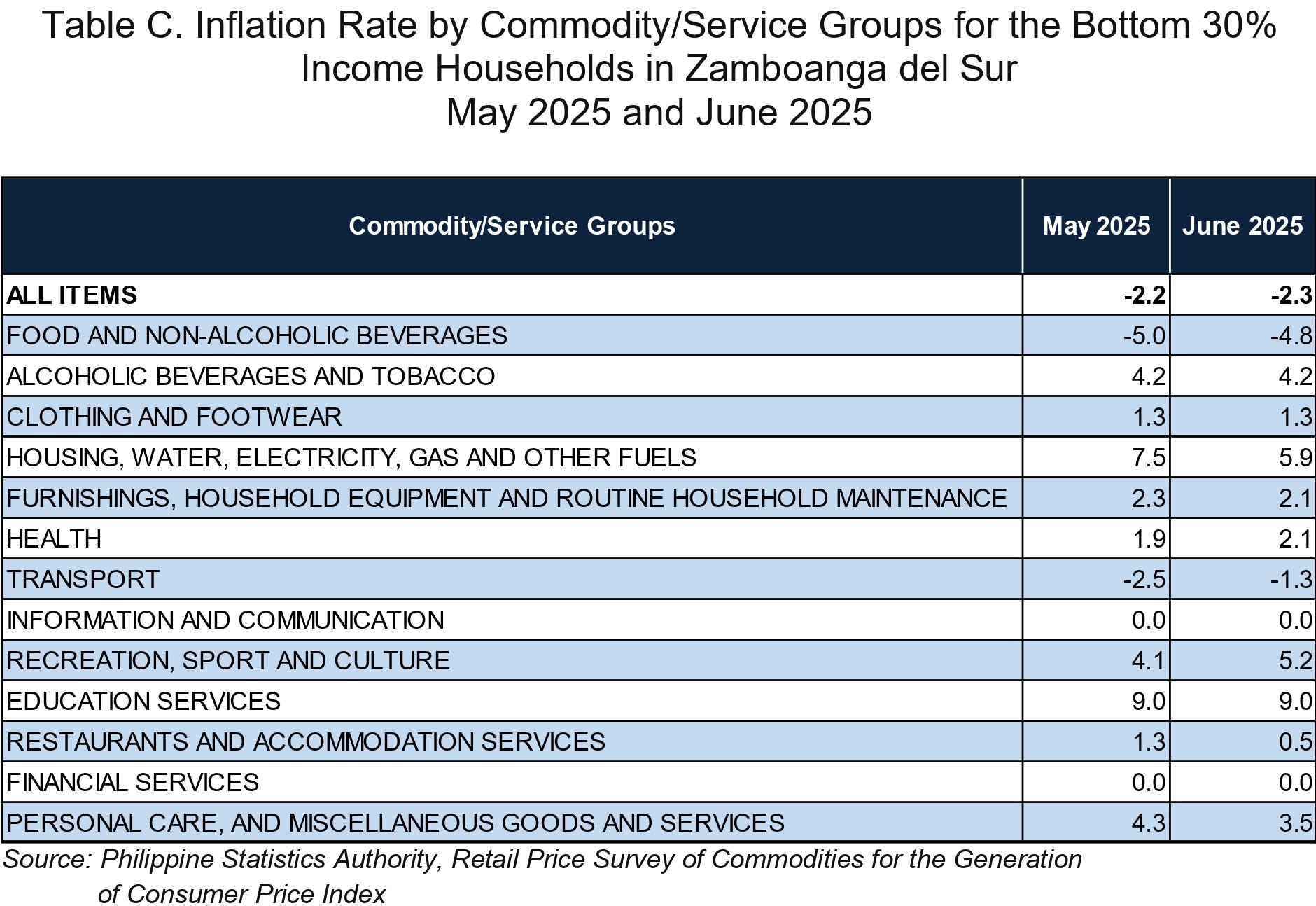

Zamboanga del Sur’s inflation for the bottom 30% income households posted a faster annual decline of 2.3 percent in June 2025 from an annual drop of 2.2 percent in the previous month. In June 2024, the inflation rate was posted at 8.0 percent. (Tables A and B, and Figure 1)

1.1 Main Drivers to the Downtrend of the Overall Inflation

The downward trend in the overall inflation for this income group in June 2025 was primarily brought about by the slower annual increase in the index of housing, water, electricity, gas and other fuels at 5.9 percent during the month from 7.5 percent in the previous month. Also contributing to the downtrend was the slower year-on-year increase in the index of personal care, and miscellaneous goods and services at 3.5 percent during the month from 4.3 percent in May 2025.

Moreover, lower annual rate was noted in the index of restaurants and accommodation services at 0.5 percent during the month from 1.3 percent in May 2025, and furnishings, household equipment and routine household maintenance at 2.1 percent in June 2025 from 2.3 percent in the previous month.

In contrast, higher annual increments were noted in the indices of the following commodity groups during the month:

a. Food and non-alcoholic beverages, -4.8 percent from -5.0 percent;

b. Health, 2.1 percent from 1.9 percent;

c. Transport, -1.3 percent from -2.5 percent; and

d. Recreation, sport and culture, 5.2 percent from 4.1 percent.

The indices of alcoholic beverages and tobacco, clothing and footwear, information and communication, education services, and financial services retained their previous month’s annual increment. (Table C)

1.2 Main Contributors to the Overall Inflation

Among the commodity groups, the main contributors to the June 2025 overall inflation were the following:

a. Food and non-alcoholic beverages with 143.0 percent share or -3.29 percentage points; and

b. Transport with 2.4 percent share or -0.05 percentage point.

2.0 Food Inflation

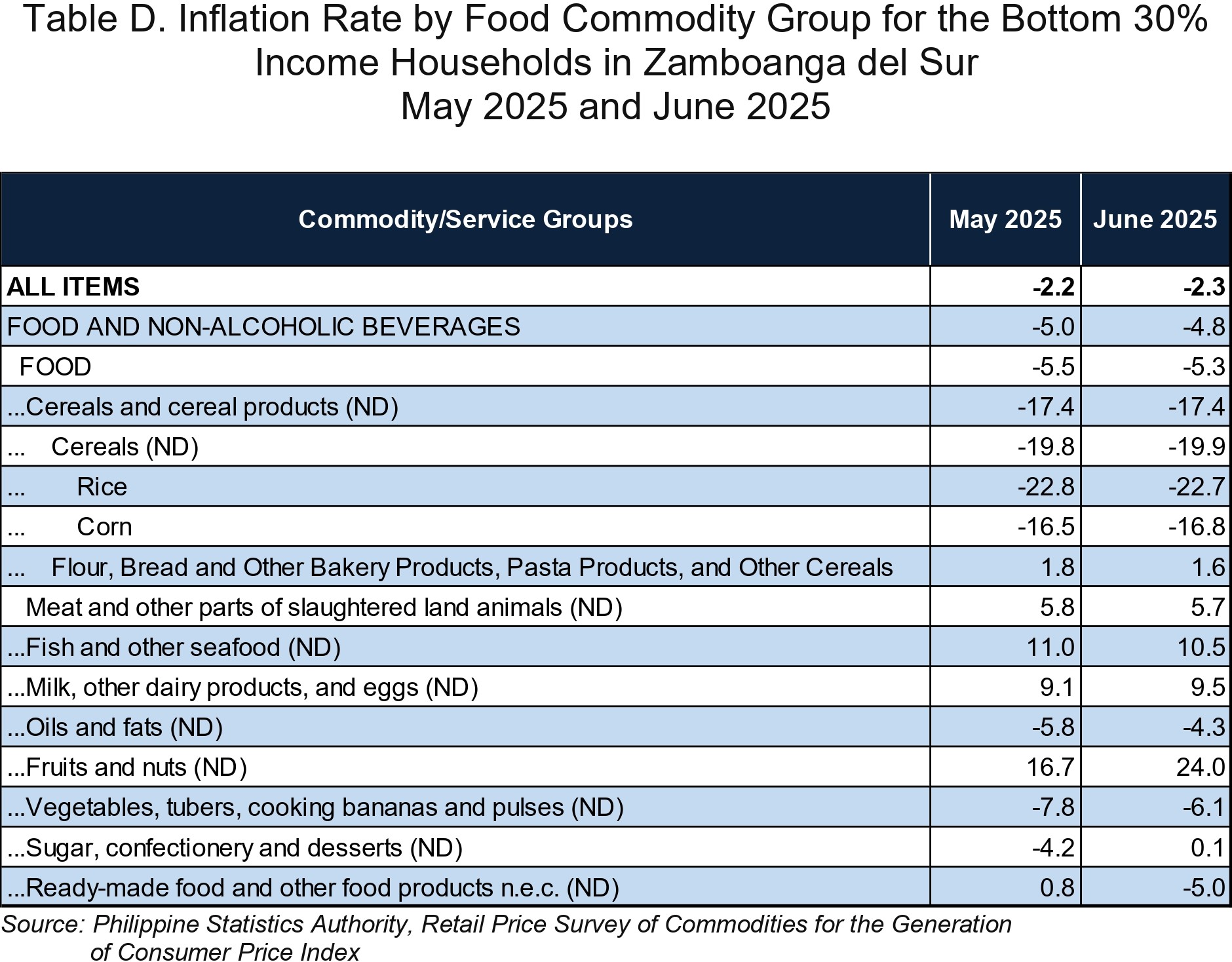

Food inflation for the bottom 30% income households in the province posted a slower annual decline of 5.3 percent in June 2025 from an annual decrease of 5.5 percent in the previous month.

2.1 Main Drivers to the Upward Trend of Food Inflation

The acceleration of food inflation in the province was mainly brought about by the faster annual increase in the index of fruits and nuts at 24.0 percent during the month from 16.7 percent in May 2025. Also contributing to the uptrend was the slower annual decrease in the index of vegetables, tubers, plantains, cooking bananas and pulses at 6.1 percent in June 2025 from an annual drop of 7.8 percent in the previous month.

In addition, higher annual increments were noted in the indices of the following food groups:

a. Milk, other dairy products and eggs, 9.5 percent from 9.1 percent;

b. Oils and fats, -4.3 percent from -5.8 percent; and

c. Sugar, confectionery and desserts, 0.1 percent from -4.2 percent.

In contrast, lower annual increments were noted in the following food groups:

a. Meat and other parts of slaughtered land animals, 5.7 percent from 5.8 percent;

b. Fish and other seafood, 10.5 percent from 11.0 percent; and

c. Ready-made food and other food products, -5.0 percent from 0.8 percent.

2.2 Main Contributors to the Food Inflation

Food inflation contributed 150.2 percent or -3.45 percentage points to the June 2025 overall inflation for this particular income group.

Among the food groups, the main contributors to the food inflation during the month were the following:

a. Cereals and cereal products with 158.0 percent share or -8.38 percentage points;

b. Vegetables, tubers, plantains, cooking bananas and pulses with 10.2 percent share or -0.54 percentage point; and

c. Ready-made food and other food products with 2.8 percent share or -0.15 percentage point.

DIMNA P. BIENES

Chief Statistical Specialist